Beautiful Work Info About How To Get Out Of Credit Card Debt In Canada

If you have multiple credit cards that are stretched to their limits, consider consolidating these debts with a single debt consolidation loan.

How to get out of credit card debt in canada. The best way to reduce your credit card debt is by using the debt avalanche method. You can use this calculatorto work out how long it will take you to pay off your credit card debt. Know that to be successful in.

How to apply for credit cards after bankruptcy in canada. Even though there is no specific dollar. Ways to pay off credit card debt.

For example, how many credit cards do you have? What’s the best way to pay down debt? Enter the minimum payment you have to make.

Type in your credit card balance and interest rate, and you will then find three options: Cut back on spending 3. Credit card debt occurs when you purchase an item or service using a credit card and fail to pay off the.

A debt consolidation loan is where a bank, credit union or finance. Consolidate your credit card debt. Listen credit cards can be a wonderful financial tool, earning you rewards or extra money for everyday purchases — but only if you’re able to repay your balance.

This process is more preferable than filing a bankruptcy. Negotiating credit card debt relief means asking your credit card companies to lower the interest rates they are charging you. Negotiate credit card debt relief yourself.

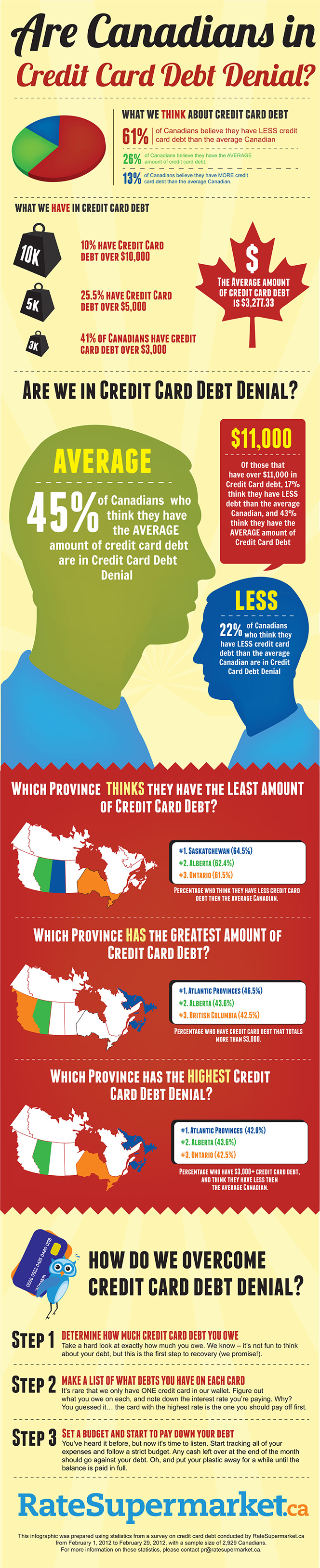

It really depends on your personal situation and income, what’s manageable for one person may be a problem for another. The moneysense guide to debt management: Sifting through the evergrowing credit card options available to choose just the right card for you.

Credit card debt can be crippling since most credit cards have an interest rate of 20% or more. We’re broadcasting to you on e1, skar tv, ntn and tarzee tv in bartica. For $25 a month, they consolidate the debt into one lump sum and get negotiated lower interest rates.

How to get out of debt; That’s significantly higher than other kinds of debt , such as. Evaluate your finances start by taking a close look at your financial situation.

Enter the minimum payment plus an extra. Although you will have to give up your unsecured cards when completing a dcp, it’s often the best way to get out of credit card debt (and stay out of it)! The more you need a good rate, the harder it is to get one.