Unique Info About How To Apply For Rent Allowance

You can apply for the healthcare benefit, rent benefit and supplementary child benefit for a certain year up to 1 september of the following year.

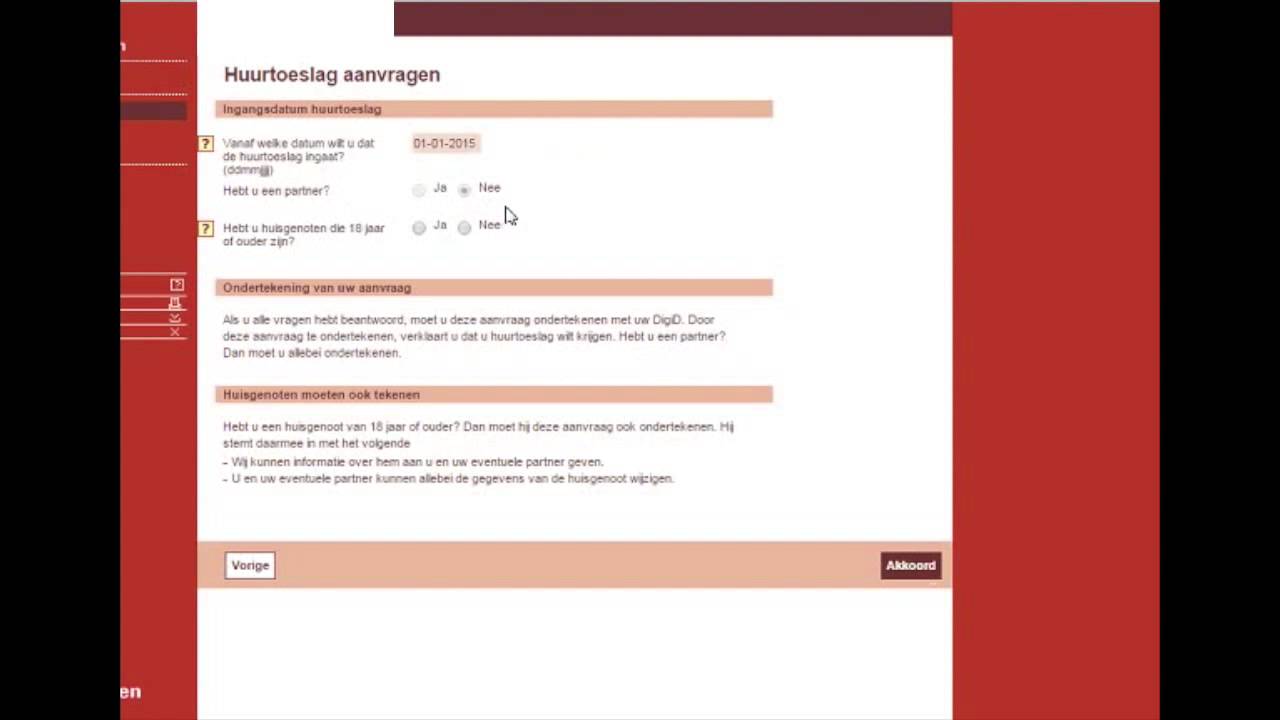

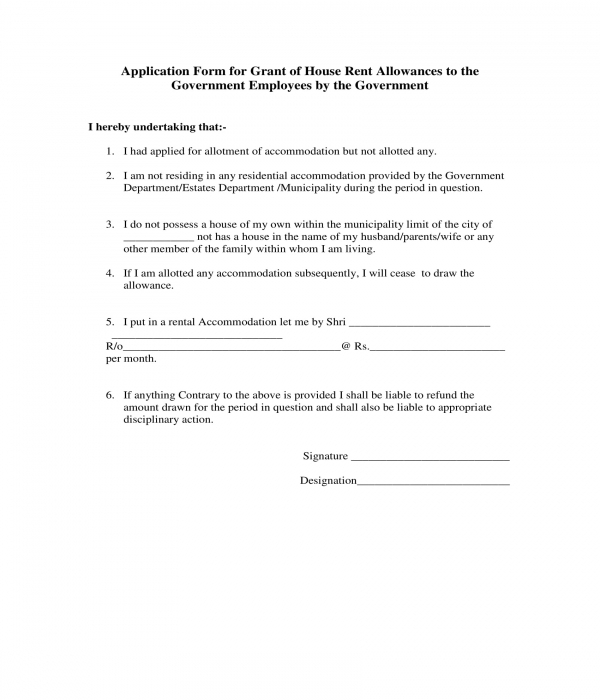

How to apply for rent allowance. How to apply for new €500 rent relief announced in budget 2023. Supplementary welfare allowance rent supplement (swa rs1) updated: If you do not already have a digid, you can.

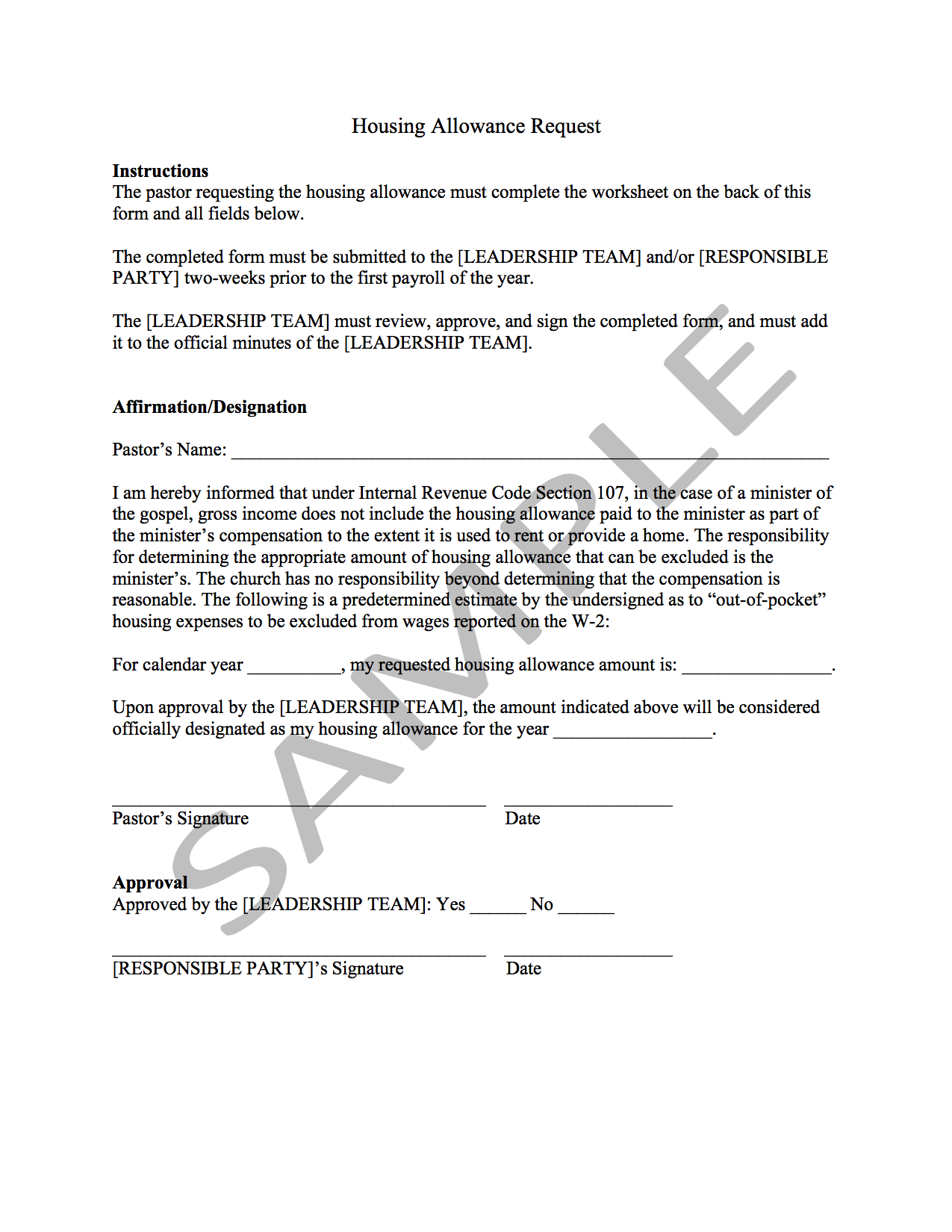

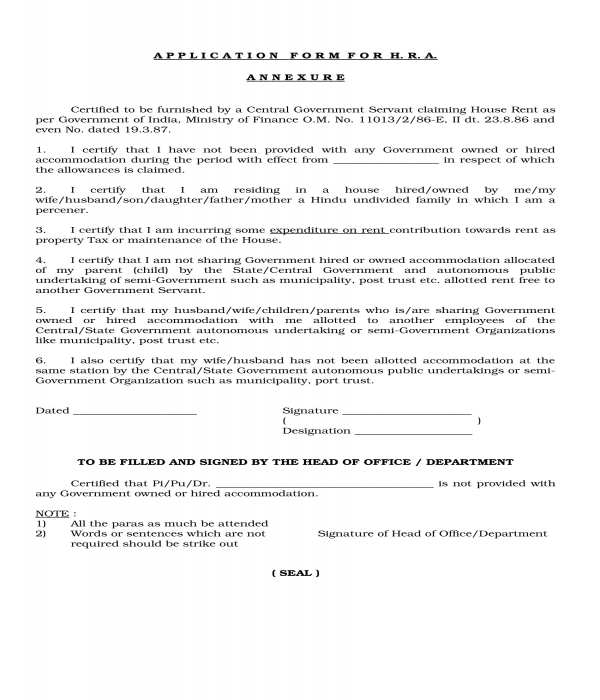

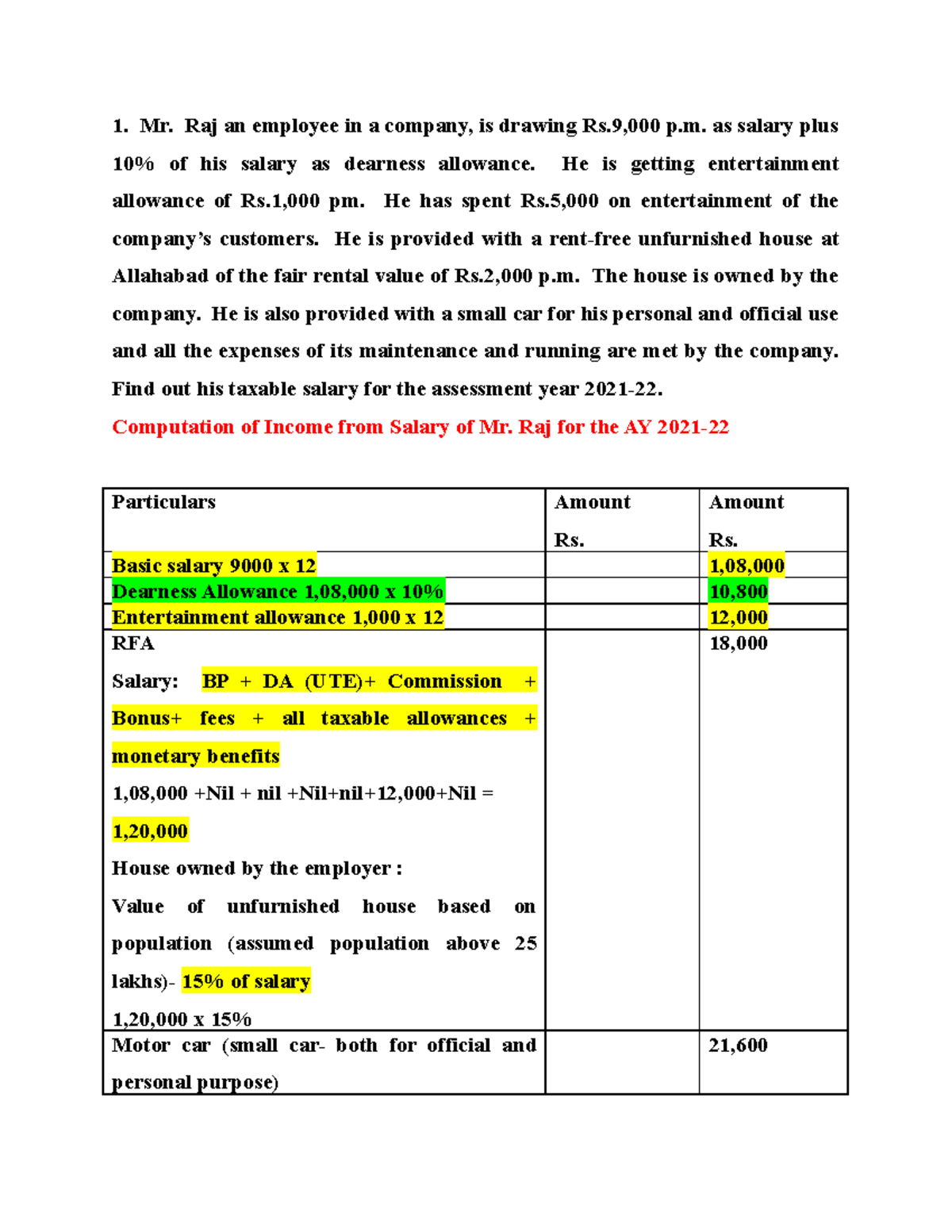

Find out what your income in excess of the swa rate is. The maximum value is €500 in. The rent allowance application form (rs1) must be completed in full and signed or marked by the applicant and witnessed as appropriate in all cases.

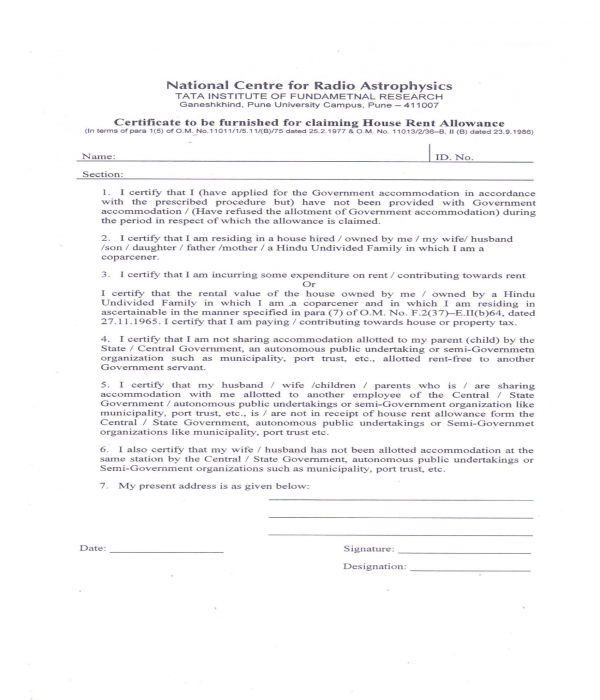

There’s no set amount of housing. If you want to apply for the rent subsidy in the netherlands, then you need to go to the government. Eligibility criteria for rent allowance.

Calculate your gross assessable weekly income from all sources. There are a few exceptions, so be sure to check whether you. To apply for rent supplement, you should contact the department of social protection’s representative at your local intreo centre or social welfare branch office.

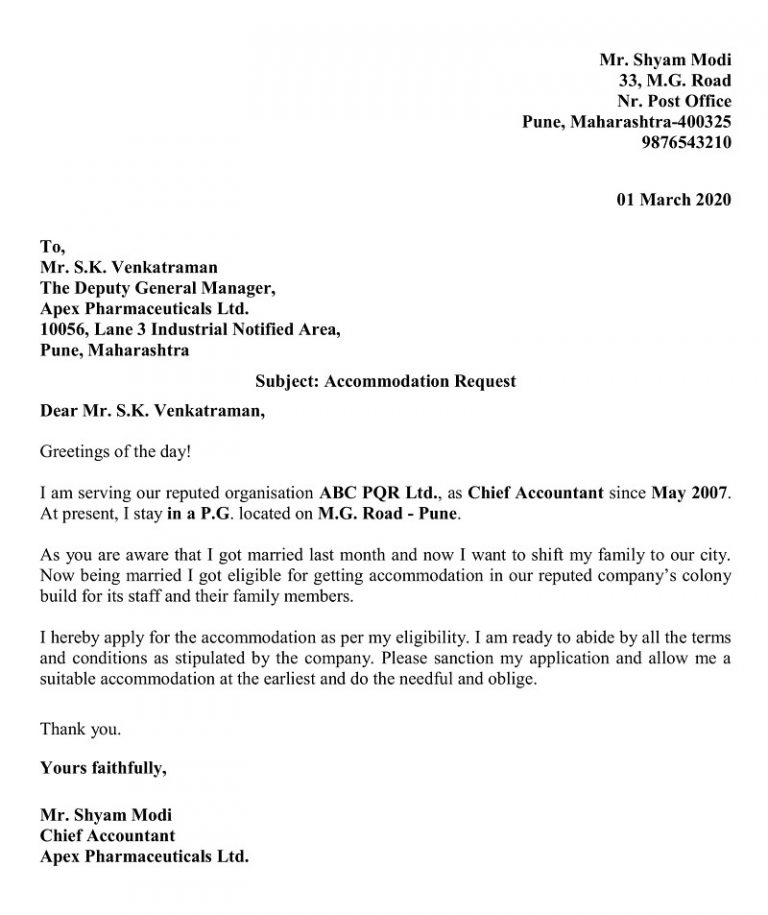

What changed in 2024 for rent allowance? Application for house rent allowance. You may, for example, apply for a.

In this post, we will explain how the rent benefit works, whether you qualify, and how to apply for the benefits. If you comply to all of the above conditions, you can apply for rent allowance through the website of the dutch tax authority. Other help with housing costs.

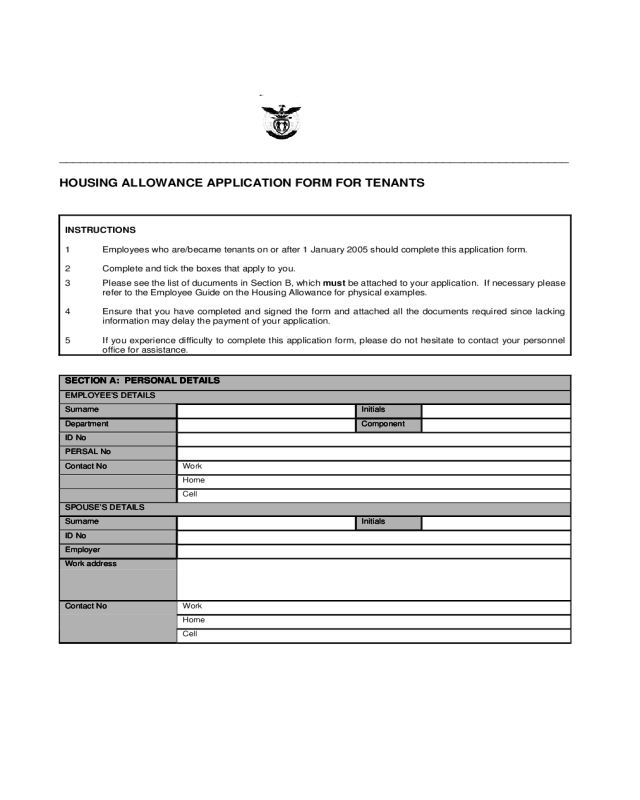

In order to apply for rent allowance, you need a digid, a secured password of the dutch government to apply for the allowance. If you are renting your home, you may be eligible to receive huurtoeslag (housing benefit). How do i apply for the rent allowance in the netherlands?

Click on ‘complete your income tax return’. Respected sir/ madam, most humbly, my name is ________ (name) and i have been working in your company as. Housing benefit is a contribution towards the payment of your rent.

You can apply for rent allowance for houses with a basic rent below the limit of € 808.06 (reference year 2023). Check if you can get rent assistance. For 2022 and 2023, the maximum value of the rent tax credit is €1,000 per year for jointly assessed married couples or civil partners.

You can apply for rent allowance from the tax office via ' ik wil een toeslag aanvragen '. Steps to get rent assistance. Special rules apply if you either: